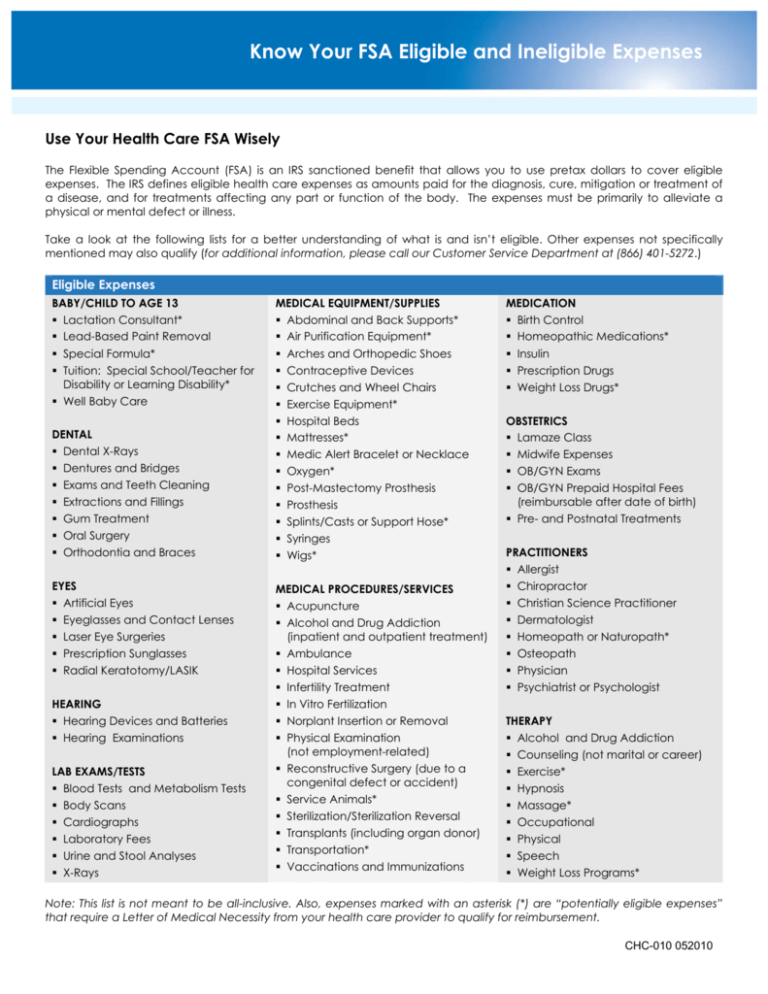

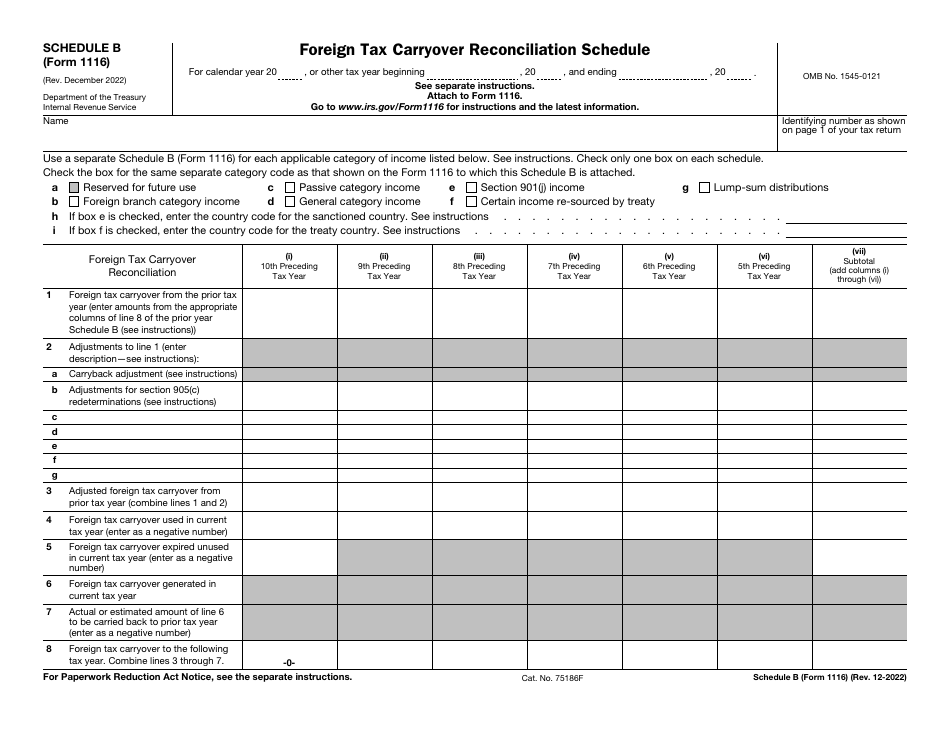

Irs Fsa Rollover 2024 To 2024. The irs establishes the maximum fsa contribution limit each year based on inflation. The irs confirmed that for plan years beginning on or after jan.

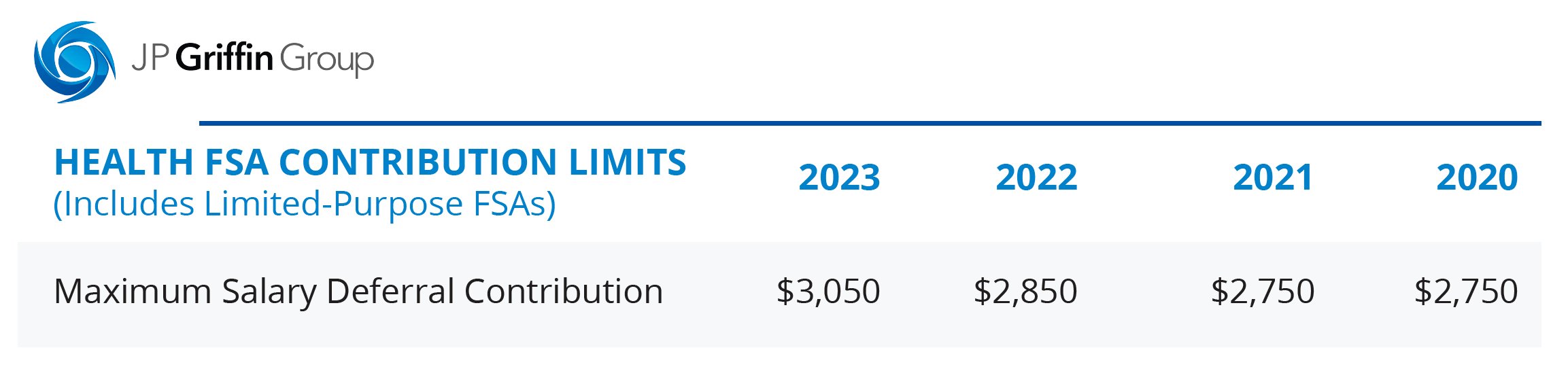

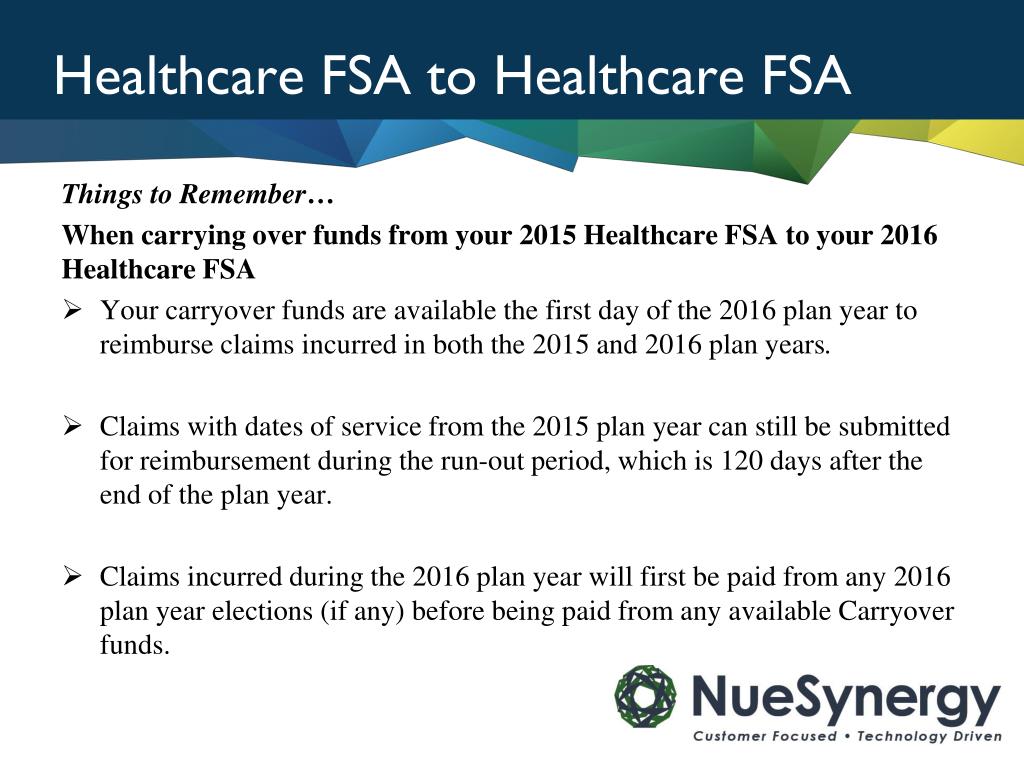

The 2024 maximum fsa contribution limit is $3,200. If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules).

Irs Fsa Rollover 2024 To 2024 Images References :

Source: helynyoctavia.pages.dev

Source: helynyoctavia.pages.dev

2024 To 2024 Fsa Rollover Limit Billye Lorrin, For 2024, there is a $150 increase to the contribution limit for these accounts.

Source: claireyjacquelyn.pages.dev

Source: claireyjacquelyn.pages.dev

Irs Max Rollover For Fsa 2024 Dulcea Melitta, The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year).

Source: denisebfederica.pages.dev

Source: denisebfederica.pages.dev

Fsa Rollover 2024 To 2024 Alaine Sybila, In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Source: buffybbernetta.pages.dev

Source: buffybbernetta.pages.dev

2024 Fsa Carryover Allowance Helga Madelina, 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200.

Source: daricebchrissy.pages.dev

Source: daricebchrissy.pages.dev

2024 Fsa Rollover Limits In India Sande Cordelia, But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: kacyyalexina.pages.dev

Source: kacyyalexina.pages.dev

Fsa Limits 2024 Rollover Rate Marla Philippine, The fsa contribution limits increased from 2023 to 2024.

Source: naraymarrilee.pages.dev

Source: naraymarrilee.pages.dev

2024 Fsa Rollover Limit 2024 Tedra Vivian, If you don’t use all the funds in your account, you.

Source: zeldaqbernadette.pages.dev

Source: zeldaqbernadette.pages.dev

Fsa Rollover 2024 To 2024 Irs Dita Donella, For 2024, you can contribute up to $3,200 to an fsa.

Source: judyeyulrikaumeko.pages.dev

Source: judyeyulrikaumeko.pages.dev

Fsa Rollover Limits 2024 Kaela Dorothea, But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: abbeyylaetitia.pages.dev

Source: abbeyylaetitia.pages.dev

Irs Max Rollover For Fsa 2024 Gale Thomasina, How do fsa contribution and rollover limits work?

Posted in 2024