Ira Income Limits 2024 Over 65. Limits on roth ira contributions based on modified agi. Those aged 50 and older can contribute an additional.

If you’re age 50 or older, you’re eligible for extra contributions as well. Good news for ira contribution limits.

Ira Income Limits 2024 Over 65 Images References :

Source: jerrinewglad.pages.dev

Source: jerrinewglad.pages.dev

Contribution Limits 2024 Ira Kaye Savina, Amount of roth ira contributions that you can make for 2024.

Source: nanceewadah.pages.dev

Source: nanceewadah.pages.dev

What Is The Limit For Ira Contributions In 2024 Ilysa Leanora, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2024 tax year was $7,000 or $8,000 if you were age 50 or older.

Source: abbeycaitlin.pages.dev

Source: abbeycaitlin.pages.dev

Ira Limits 2024 Tax Adena Larisa, Roth ira contributions are allowable at a higher.

Source: grayceysandie.pages.dev

Source: grayceysandie.pages.dev

Ira Roth Limit 2024 Sammy Sigrid, Find out if you can contribute and if you make too much money for a tax deduction.

Source: sharonwlucy.pages.dev

Source: sharonwlucy.pages.dev

Ira Limits 2024 For Simple Interest Dorie Geralda, The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Source: idellbthalia.pages.dev

Source: idellbthalia.pages.dev

2024 Roth Ira Limits Phase Out Minda Fayette, The contribution limit on a simple ira,.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Source: inflationprotection.org

Source: inflationprotection.org

2024 ira contribution limits Inflation Protection, Ira contribution limits for 2024.

Source: maribethwmaire.pages.dev

Source: maribethwmaire.pages.dev

Roth Ira Limits 2024 Limits For Over Perla Brandais, The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

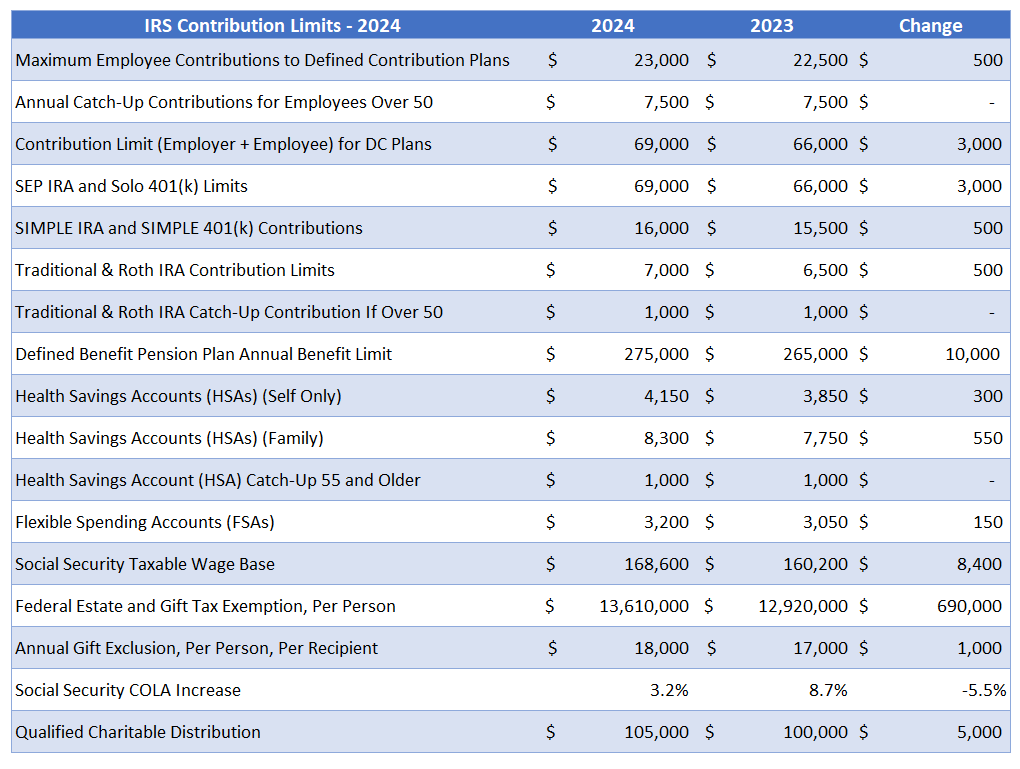

2024 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, Anyone can contribute to a traditional.