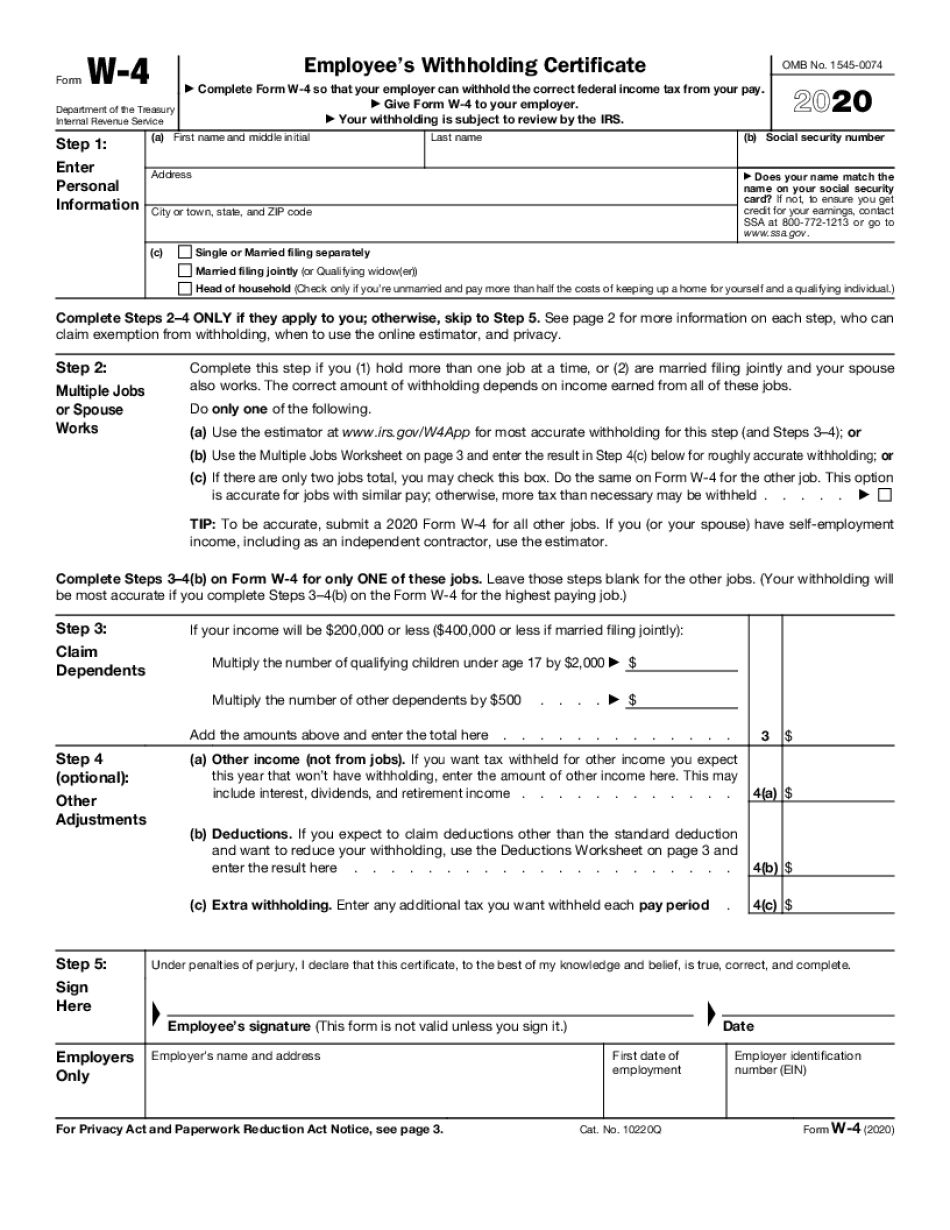

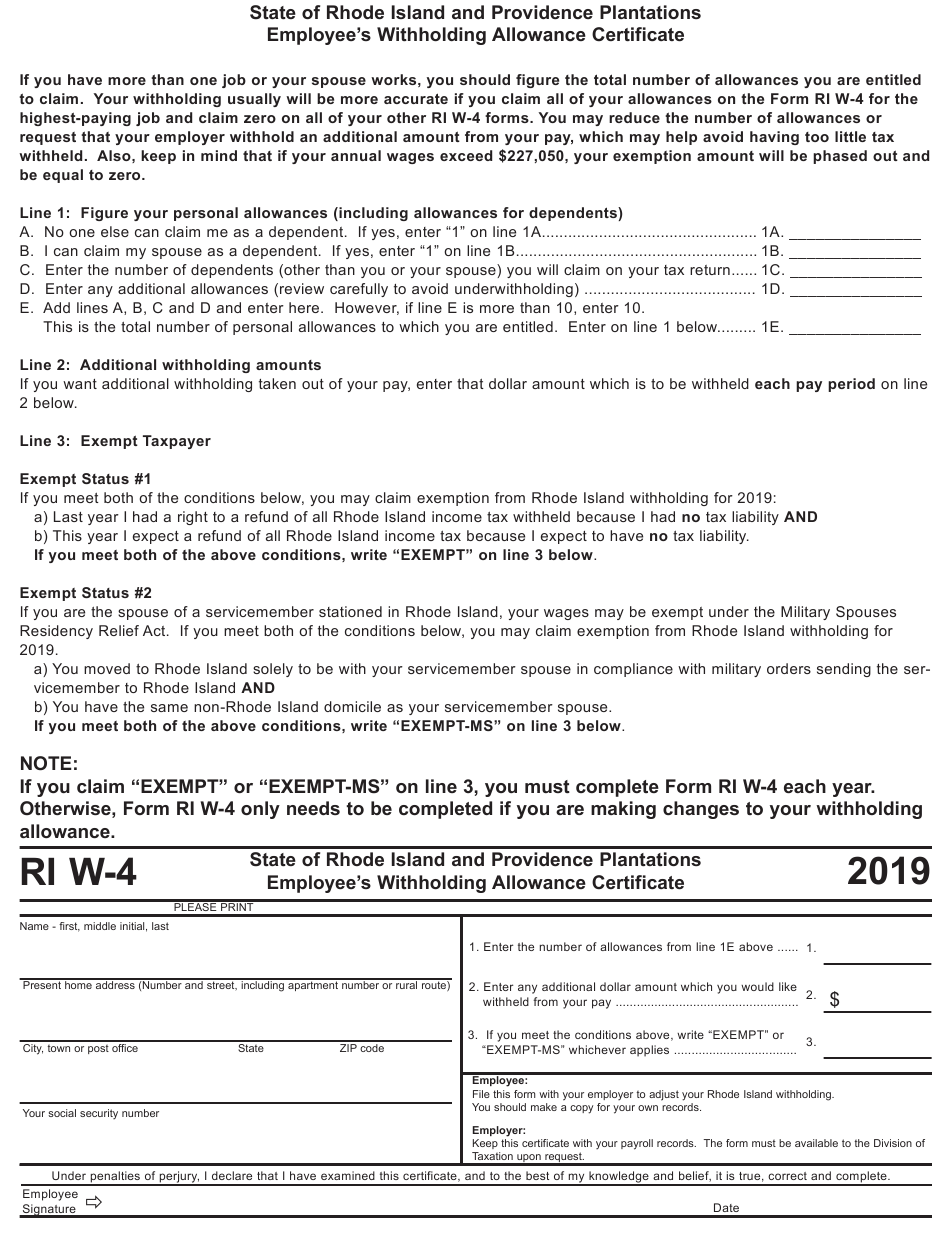

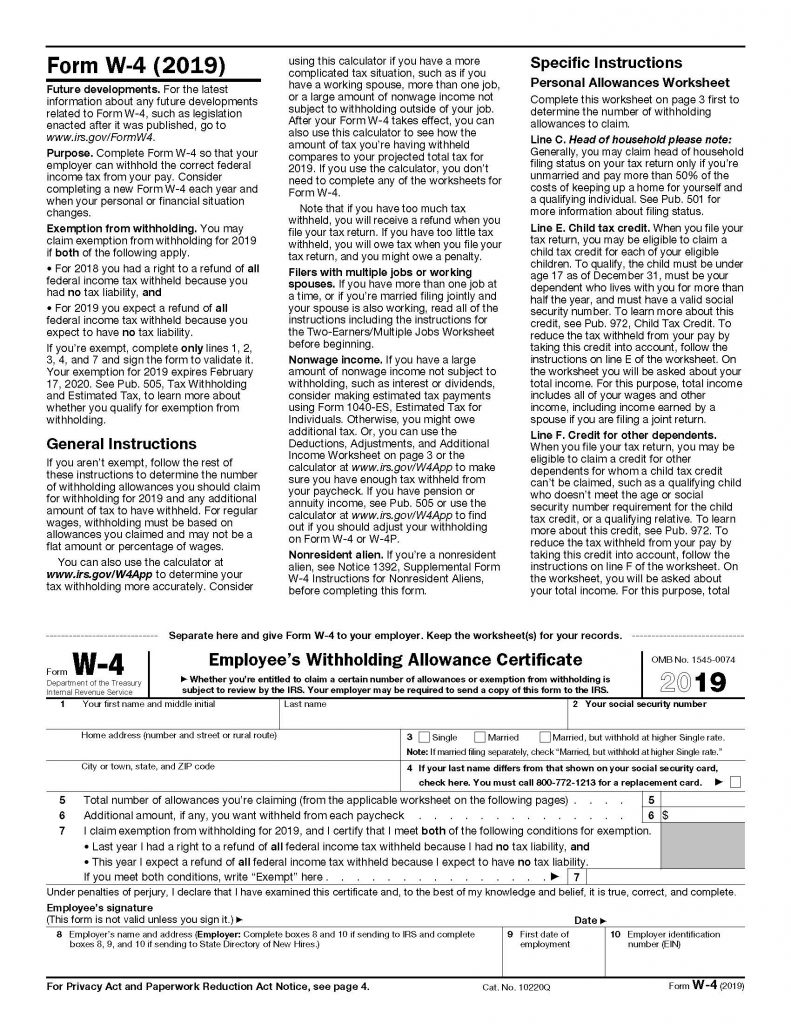

2025 Form W4. If you make $10,000 this year from other income sources, you are in the 22%. Updated on apr 24 2024.

2024 michigan income tax withholding tables. We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

If Your Filing Status, Dependents, Anticipated Tax Credits Or Deductions Have Changed Or Will Change In The Next Year,.

We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

If You Make $10,000 This Year From Other Income Sources, You Are In The 22%.

Sign the form and give it to your employer.

The Nebraska Department Of Revenue Is Issuing A.

Images References :

Source: doniellewjoyce.pages.dev

Source: doniellewjoyce.pages.dev

W4 Form 2024 Sample Bette Chelsae, We will update this page for tax year 2025 as the forms, schedules, and instructions become available. Any altering of a form to change a tax year or any reported tax period outside of the stated.

:max_bytes(150000):strip_icc()/FormW-42022-92779be669a64b0da38ce644c949a9c6.jpeg) Source: www.investopedia.com

Source: www.investopedia.com

Form W4 Employee's Withholding Certificate Definition, How to complete this form. Any altering of a form to change a tax year or any reported tax period outside of the stated.

Source: eleanorawleann.pages.dev

Source: eleanorawleann.pages.dev

W4 Withholding Calculator 2024 Joby Rosana, If your filing status, dependents, anticipated tax credits or deductions have changed or will change in the next year,. This document tells employers how much federal income tax to withhold from an employee’s pay, meaning workers should adjust.

Source: www.youtube.com

Source: www.youtube.com

W4 tax form w4 tax form. How to fill out w4 tax form . Step by step, Updated on apr 24 2024. Voluntary withholding request from the irs' website.

The new IRS Form W4 has many scratching their heads Here's what you, How to complete this form. The nebraska department of revenue is issuing a.

Source: onpay.com

Source: onpay.com

Meet the New W4 Form! What Employers Need to Know OnPay, How to complete this form. Sign the form and give it to your employer.

Source: www.youtube.com

Source: www.youtube.com

How To Fill Out W4 Tax Form In 2022 FAST UPDATED YouTube, Any altering of a form to change a tax year or any reported tax period outside of the stated. If too little is withheld, you will generally owe tax when you file your tax return.

Source: korellawcorri.pages.dev

Source: korellawcorri.pages.dev

W4 2024 Printable Form Maxie Rebeca, Employees, particularly in the context of the 2024 version. What is this form for?

Source: www.thinglink.com

Source: www.thinglink.com

W4 Form, The irs annually renews this form so if you’re going to fill out a new. Voluntary withholding request from the irs' website.

Source: www.esigngenie.com

Source: www.esigngenie.com

Blank W4 Form Fillable Online W4 Blank Form 2021, Any altering of a form to change a tax year or any reported tax period outside of the stated. If you make $10,000 this year from other income sources, you are in the 22%.

Updated For 2024 (And The Taxes You Do In 2025), Simply.

W4 tax form withholding 2024.

W4 Form 2024 Sample Bette Chelsae, First, If Your Spouse Earns An Income,.

This document tells employers how much federal income tax to withhold from an employee’s pay, meaning workers should adjust.